how we help

Collectors

- Access our Artwork Market Values to know the value of your collection;

- Monitor Artwork Market Values, AMVs, and KPMs to proactively manage your collection;

- Identify and understand the risks to your collection; and,

- Manage your collection to realize optimal outcomes.

Overview

Treat Your Art as an Investment

Increase financial due diligence on your art with data visualization tools that provide a number of standardized, transparent, and objective valuation and performance measurements for artists and artworks. Art Auction Analytics complements connoisseurship with key financial data to support your art collection:

- Buying what you love at the right price and selling when you need to;

- Having ready access to market data that may impact the value of your artwork;

- Understanding the implications of value changes to long-term collection maintenance.

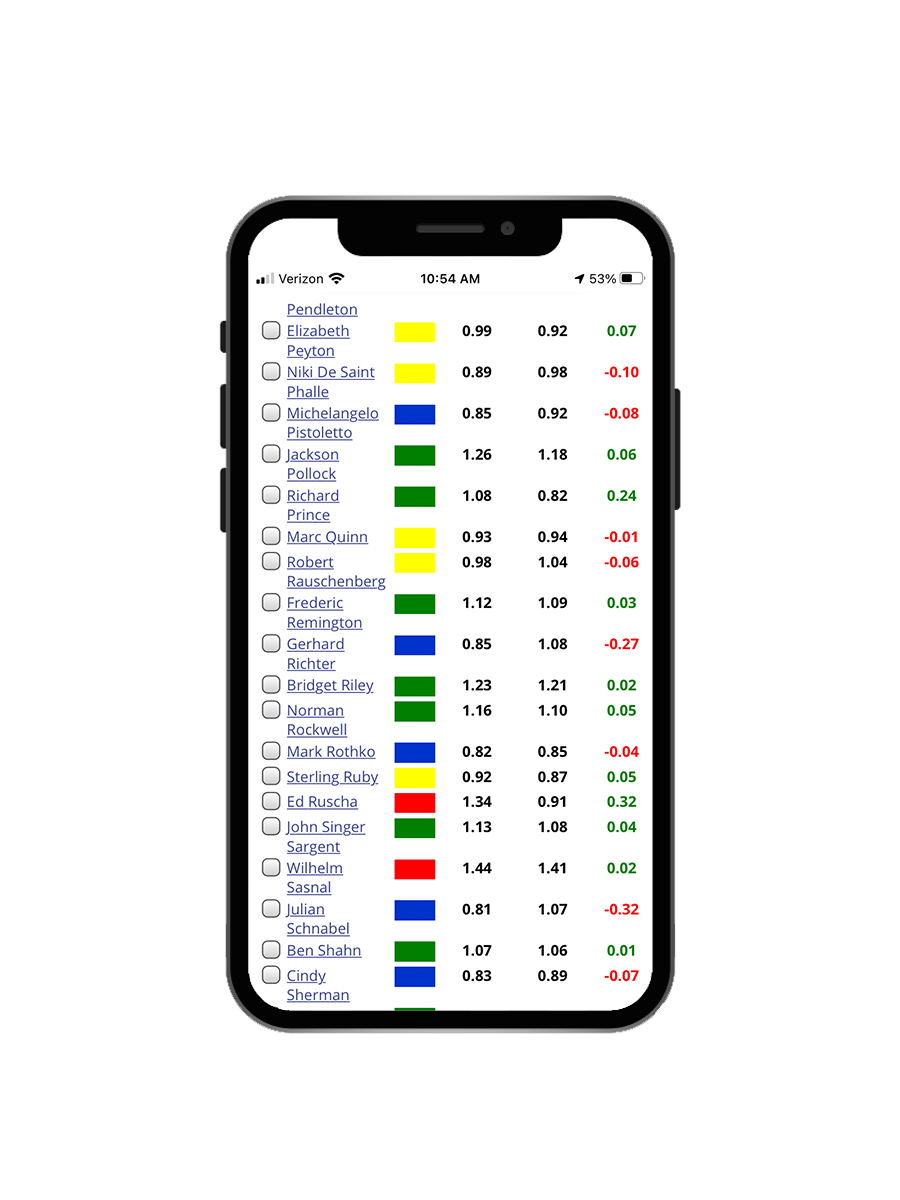

Easy to interpret, and accessible on any device, our platform is designed to support you with managing the valuation of your art portfolio, similar to any other financial asset in an investment portfolio.

Know the Value of Your Collection

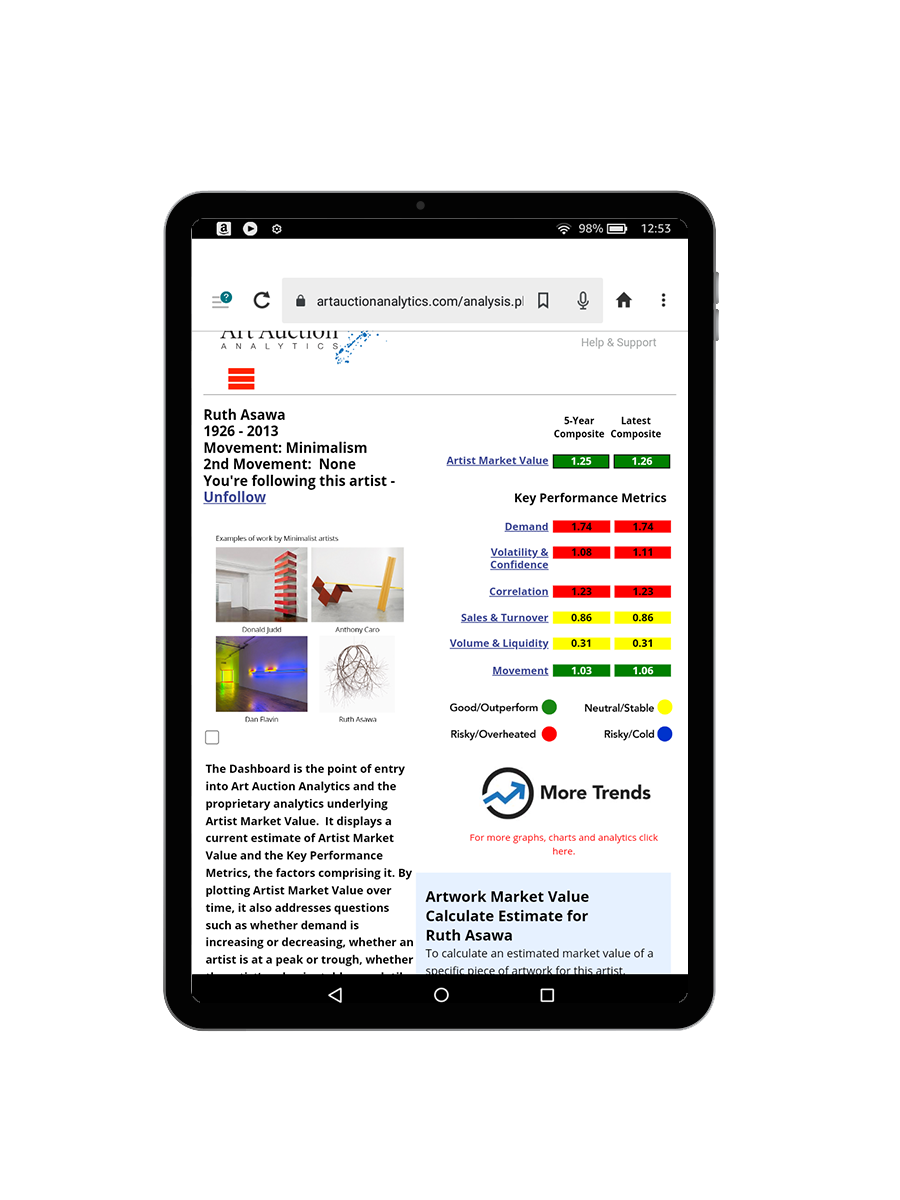

Art Auction Analytics’ Artwork Market Value tool sets the standard for a rational approach to quickly obtaining the market value of an artwork purchased or appraised within the last five years. The Artwork Market Value tool is driven by AMV and the underlying KPMs, which provide the most comprehensive insights into what an artist’s artworks would sell for in the market today. The output is the equivalent of the fair market value price for an artwork.

You can use the Artwork Market Value tool to value your collection for:

- Estate planning

- Filing taxes

- Loaning out a collection

- Obtaining insurance

- Selling artworks

Pro-Actively Manage Your Collection

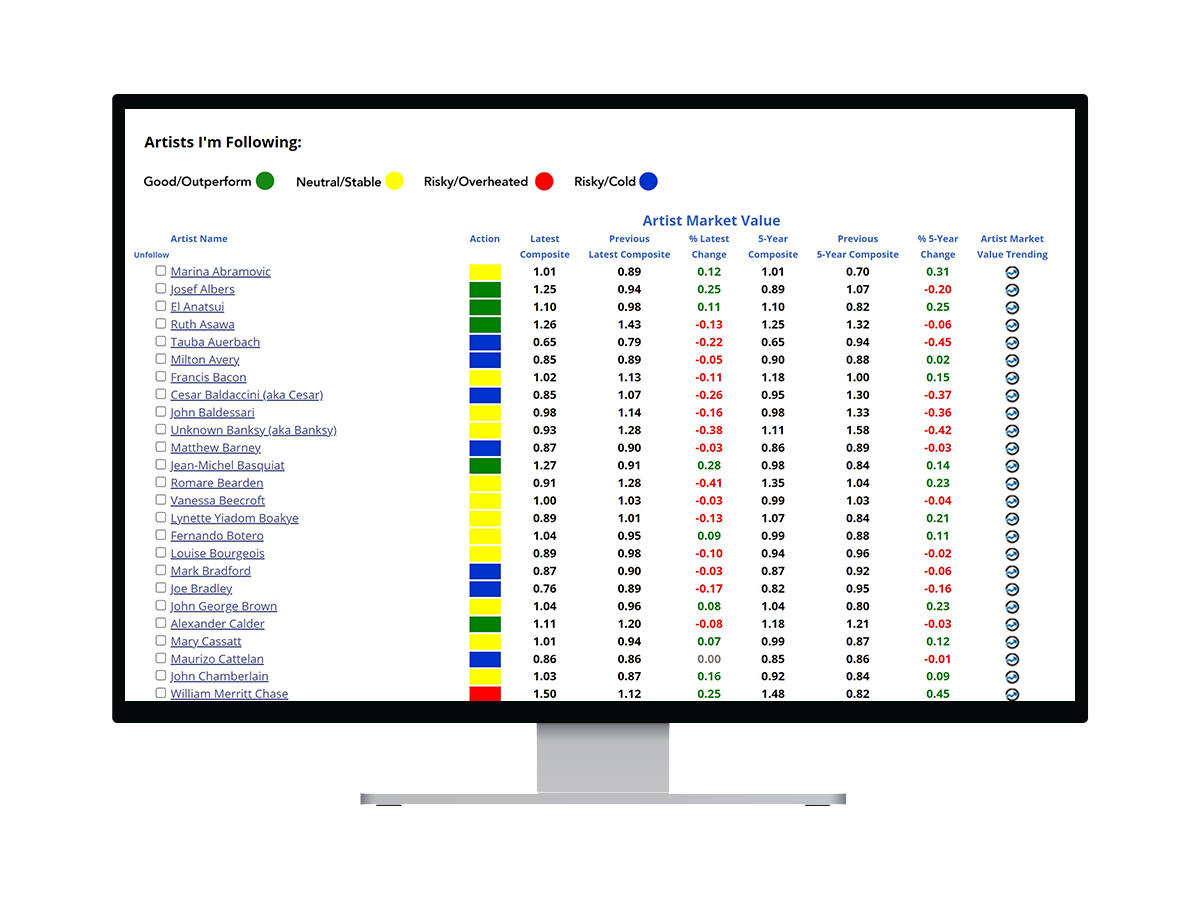

Make use of the asset tracking feature of our Artwork Market Value tool, which is updated monthly, to actively monitor changes in the value of your artworks.

To the extent you have noticed a change in value, investigate further, using our easily accessible AMV and suite of KPM indicators to analyze what is driving the change in value.

With the Art Auction Analytics platform you can identify:

- Whether an artist or artwork in your collection is currently undervalued or overvalued;

- What performance drivers (Demand, Liquidity, Volatility, etc.) are impacting the value; and

- Is the value stable or volatile; and to what extent the value may change.

Understand the Risks

We understand that collecting art has risks. When the value of an artwork drops, not only is there a financial loss, but selling the work, or leveraging it into a financial instrument such as an art-secured loan, may be in jeopardy.

Art Auction Analytics gives you the ability to get out in front of the risks to the value of your collection:

- Use our AMV and KPM trending data to determine if the risk is temporary or has the probability to be long-term; and

- Use the Artwork Market Value tool to calculate the change in value, and to establish a price at which the artwork can be sold.

Time the Market for Optimal Results

As with any other financial asset, timing the art market for the best returns is the ultimate goal. With Art Auction Analytics’ platform, you will have the insight needed prior to executing a transaction on the primary or secondary market. Whether the situation calls for on-the-spot answers or allows for a more detailed review, Art Auction Analytics has you covered.

Establish Optimal Transaction Point

Assess if this is a good time to buy or sell based on where the Artist’s AMV is now, and where it is trending.

Is the Artist in an overheated, or cold market, and what are the short-term or long-term effects?

Confirm Buy Fits Financial Strategy

Identify if an artist’s AMV and KPM profile match your risk/reward strategy.

Is a blue-chip artist a good addition to your portfolio, or an emerging artist more suited?

Calibrate the Transacation Price

Determine if the asking price is in line with the AMV for the artist.

Does the price quoted by the auction house match your expectations of value?