First published on April 6, 2021

In Bringing Clarity to the Art Market, we described Artist Market Value (“AMV”) as the cornerstone of a market-based approach to evaluating art. Building on that, we are now introducing the AAA 100 Index. Why? Market indexes like the S&P 500 are easily digestible benchmarks. If they are so widely used for stocks and bonds, and even frozen concentrated juices, why not the art market? Plus, with the Auction market really picking up steam, without access to an index, you might as well be flying blind.

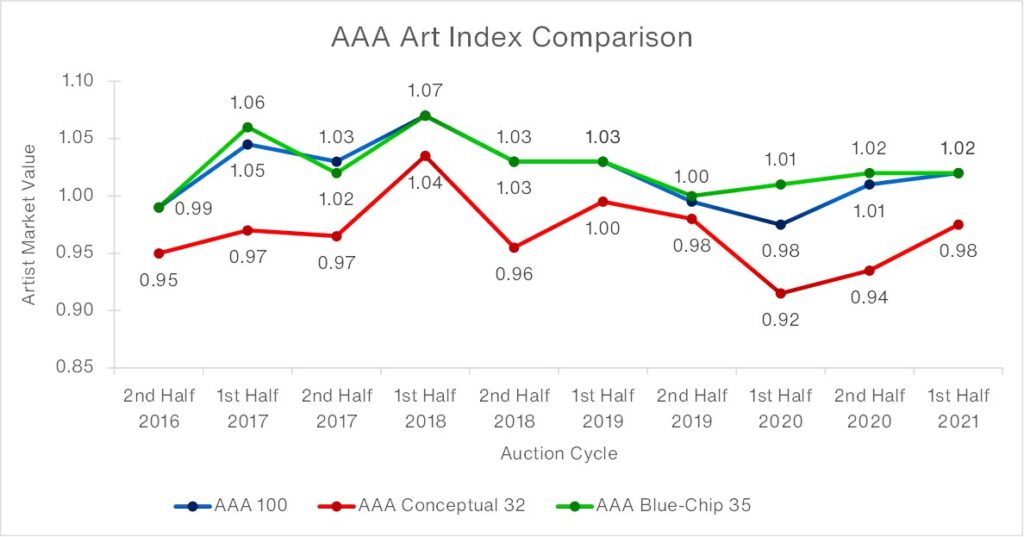

How the AAA 100 Index and other indexes work and what they tell us today

The AAA 100 is built on AMV, a comprehensive measure that factors in Key Performance Metrics that drive performance and value. It can easily be plotted over time, monitored, and used to frame expectations. It is an unweighted index of 100 leading Post War & Contemporary artists’ AMVs spanning different movements, career points, and geographies. Weighted indexes are often dominated by a small number of stocks. On the other hand, an unweighted index provides a snapshot of performance across all its components, irrespective of size.

The AAA 100 is akin to a value stock index and for context, we have included two additional indexes, one on conceptual artists, the other on blue-chip artists.

Trending is pretty revealing and provides a good basis for framing expectations (Note: Any 1st Half 2020 dips are likely Covid – related.). Through the 1st Half 2021, expect:

- The appetite for art is still heavy and the general upswing in the AMV 100 should continue.

- Beware of Conceptual-based art – it has been cooling and comparitively volatile for some time.

- Blue-Chip artists again continue to track the AAA 100, reflecting a general preference for stability.

Stay tuned! We’ll be periodically providing updates on the AAA 100 Index and introducing additional ones over the next few months. If there is a type of index you would like to see or another topic you find interesting, let us know.

0 Comments